Taking Advantage of the R&D Tax Credit

January 16, 2017 Leave a comment

Based on the nature of your business activities, you may qualify for the Research and Development (R&D) tax credit. Although we tend to think of R&D as limited to complex lab experiments, the Code offers a more flexible definition of R&D that encompasses a variety of industries and activities. In general, the credit covers activities that are intended to eliminate uncertainty about a particular product or process. Your research must be technological in nature and grounded in one of the hard sciences. In addition, substantially all of your research must contain elements of a process of experimentation where various alternatives are considered.

The R&D credit, also known as the research and experimentation (R&E) credit, was first introduced by Congress in 1981. The credit’s purpose is to reward U.S. firms for increasing spending on research and development within the U.S. The R&D credit is available to businesses that uncover new, improved, or technologically advanced products, processes, principles, methodologies, or materials. In addition to “revolutionary” activities, the credit may be available if a firm has performed “evolutionary” activities such as investing time, money, and resources toward improving its products and processes. Correctly calculating the R&D credit is critical, because the credit can be used to lower a firm’s effective tax rate and generate increased cash flow. Also, the credit can serve to further catalyze R&D capabilities and innovation.

The R&D credit continues to be underutilized by qualified firms and their business management teams. Reasons include a misunderstanding of qualification and documentation requirements for federal and state credits; fear of triggering an IRS audit in the current or prior year tax returns; and the perception that the credits are limited in scope or fleeting in nature due to their persistently short renewal periods.

In addition, recently-enacted legislation makes it easier for small businesses to take advantage of the R&D tax credit. Eligible small businesses may now use the credit to offset alternative minimum tax liabilities. Also, certain start-up businesses with gross receipts of less than $5 million may elect to offset their payroll taxes with the credit. Now is the perfect time to see if the R&D tax credit would be beneficial for you.

I would be happy to discuss this matter with you. We have consultants which can help you identify potential projects and costs that would qualify for the credit. We can also discuss ways to properly document your research activities in case of an IRS audit. Please contact me at don@kiplingerco.com to set up an exploratory no cost, no obligation, call to see if would be worthwhile for you.

More on the R&D Tax Credit

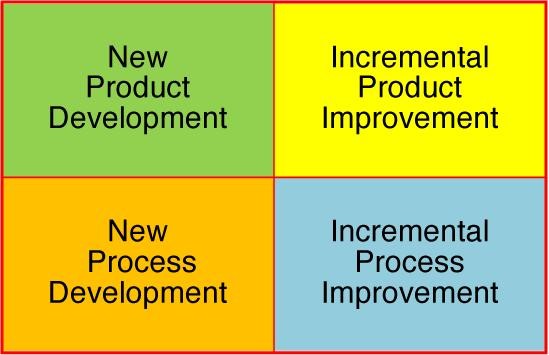

Exhibit 1. Four types of R&D tax credit qualifying research activities

The R&D credit is available to taxpayers who incur incremental expenses for qualified research activities (QRAs) conducted within the U.S. The credit is comprised primarily of the following qualified research expenses (QREs):

- Internal wages paid to employees for qualified services.

- Supplies used and consumed in the R&D process.

- Contract research expenses (when someone other than an employee of the taxpayer performs a QRA on behalf of the taxpayer, regardless of the success of the research). Many times supervisory efforts of senior scientists and owners are missed because those expenses do not reside in the traditional cost buckets.

- Basic research payments made to qualified educational institutions and various scientific research organizations.

Specific examples of qualifying activities include:

- Development of software that provides a computer service when customers are using the company’s computer or software technology.

- Design or development of any new software or technology products for commercial sale, lease, or license.

- Software developed as part of a hardware/software product (embedded software).

- Modification or improvement of an existing software or technology platform that significantly enhances performance, functionality, reliability, or quality.

- New architecture design.

- Integrating legacy applications and provisioning across virtual environments.

- Development of new communication and security protocols.

- Design of database management systems.

- IUS development.

- Developing software to improve planning capabilities as part of the supply chain process, including enhanced efficiencies and new functionality.

- Programming software source code.

- Advanced mathematical modeling.

- Research of specifications and requirements, domain, software elements including definition of scope and feasibility analysis for development or functional enhancements.

- Beta testing-logic, data integrity, performance, regression, integration, or compatibility testing.

- Optimization of code for product performance issues, new features, or integration with new platforms or operating systems.

- Research for development of applications for technology patents.

- Design of database backend.

- Developing financial analytics engines to improve forecast quality and coverage.

- Software development to improve system reliability and uptime and computer resource efficiency.

- Optimizing data access patterns.

- System architecture research to improve scalability, functionality, or improved performance.

- Software design to work with different databases.

- Rapid prototyping.

- Development related to performance issues such as systems running too slowly or bottlenecking.

For an activity to qualify for the research credit, the taxpayer must show that it meets the following four tests:

- The activities must rely on a hard science, such as engineering, computer science, biological science, or physical science.

- The activities must relate to the development of new or improved functionality, performance, reliability, or quality features of a structure or component of a structure, including product or process designs that a firm develops for its clients.

- Technological uncertainty must exist at the outset of the activities. Uncertainty exists if the information available at the outset of the project does not establish the capability or methodology for developing or improving the business component, or the appropriate design of the business component.

- A process of experimentation (e.g., an iterative testing process) must be conducted to eliminate the technological uncertainty. This includes assessing a design through modeling or computational analysis.

Determining the true cost of R&D is often difficult because few firms have a project accounting system that captures many of the costs for support provided by the various personnel who collaborate on R&D. The typical project tracking system may not include contractor fees, direct support costs, and salaries of high-level personnel who participate in the research effort.

Appropriate documentation may require changes to a firm’s recordkeeping processes because the burden of proof regarding all R&D expenses claimed is on the taxpayer. The firm must maintain documentation to illustrate the nexus between QREs and QRAs. According to the IRS Audit Techniques Guide for the R&D credit, the documentation must be contemporaneous, meaning that it was created in the ordinary course of conducting the QRAs. Furthermore, a careful analysis should take place to evaluate whether expenses associated with eligible activities performed in the firm outside of the R&D department may have been missed and can be included in the R&D credit calculation. This is accomplished by interviewing personnel directly involved in R&D or those who are in support or supervision of R&D efforts.

Again, please feel free to contact me at don@kiplingerco.com to schedule an exploratory no cost, no obligation call to see if would be worthwhile for you.

Posted by Don James, CPA/CFP